A recent study revealed that nearly half of Americans with bad credit are actively seeking ways to manage their debt, with many turning to bill consolidation loans as a potential solution. The promise of a single, manageable payment for multiple debts can feel like a financial solution, but it’s important to approach bill consolidation loans with a clear understanding of the potential benefits and risks. However, for individuals with less-than-perfect credit, securing a loan with favorable terms can be a difficult journey.

Toc

In this comprehensive guide, we’ll explore the complexities of bill consolidation loans for those facing financial difficulties, offering insights into the potential benefits, risks, and strategies for navigating the process.

Understanding the Power of Bill Consolidation Loans

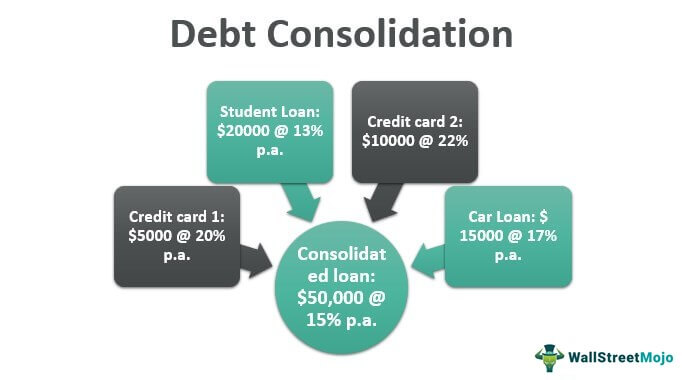

A bill consolidation loan acts like a financial umbrella, gathering your scattered high-interest debts, such as credit cards, medical bills, or payday loans, under one monthly payment. By consolidating your debt, you may be able to secure a lower interest rate, potentially saving you money in the long run. Additionally, this strategy can simplify your finances by reducing the number of payments you need to track each month.

The key benefits of a bill consolidation loan include:

Streamlined monthly payments

By consolidating multiple debts into one, you relieve the stress of managing several accounts with different due dates and minimum payments. This simplification allows for a more organized financial approach, making it easier to focus on a single payment deadline rather than juggling many. Moreover, with streamlined monthly payments, you are less likely to miss payments, which can help improve your credit score over time.

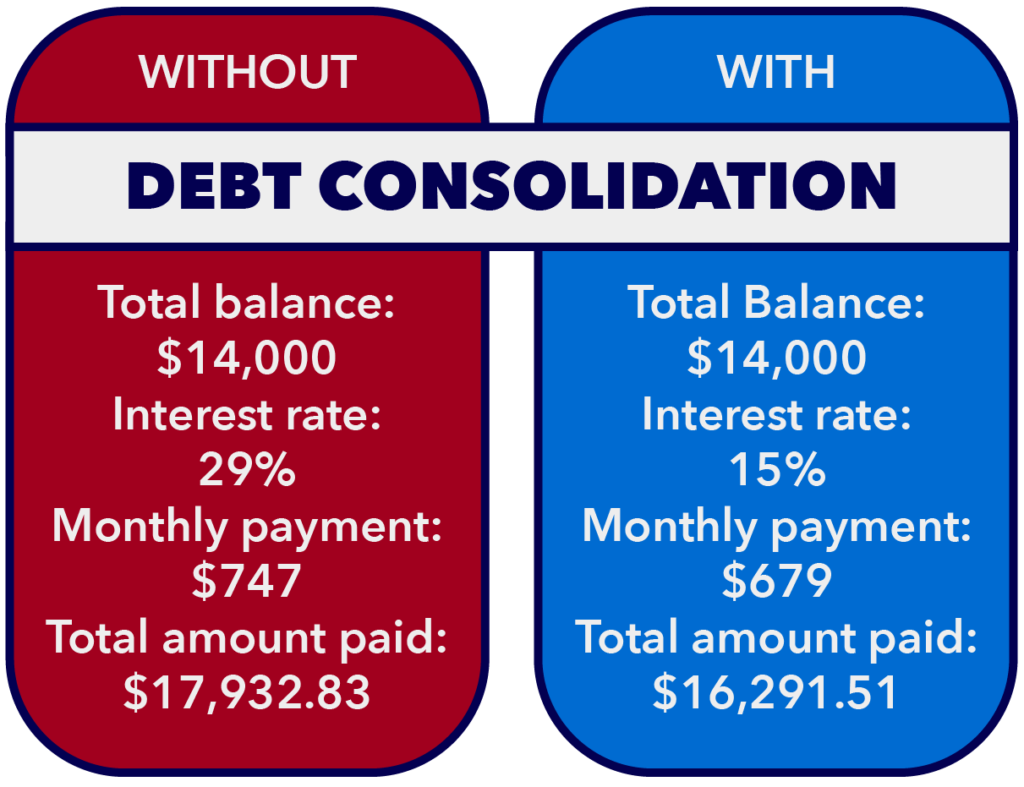

Lower Interest Rates

One of the primary attractions of a bill consolidation loan is the potential to secure a lower interest rate than those attached to your existing debts. High-interest debts from credit cards and payday loans can quickly accumulate, creating a financial burden that’s difficult to escape. By obtaining a lower interest rate, you can reduce the overall cost of your debt, which may lower your monthly payment and make debt repayment more manageable.

Potential Drawbacks

Despite the appealing benefits, it’s crucial to be aware of the potential drawbacks associated with bill consolidation loans. For those with poor credit history, finding a loan at an affordable rate might be challenging. Additionally, the temptation to accumulate more debt once previous obligations are consolidated should be resisted, as it can lead to further financial distress. It is important to consider whether the consolidation truly addresses the root causes of financial difficulties and leads to improved money management habits.

Assessing Eligibility for Bill Consolidation Loans

Before proceeding with a bill consolidation loan, it’s essential to evaluate whether you qualify for one, especially when dealing with poor credit scores. Many lenders offer pre-qualification processes that allow you to check your eligibility without impacting your credit score. This step can help you understand what loan terms you might qualify for, including potential interest rates and repayment terms. Factors that typically affect eligibility include your credit score, income, and current debt obligations.

Improving Your Chances of Approval

If your initial assessment indicates that you might not qualify for favorable loan terms, consider strategies to enhance your application. Improving your credit score before applying can be particularly advantageous. This may involve paying down existing debts, making all payments on time, and disputing any inaccuracies on your credit report. Furthermore, documenting a stable income can help demonstrate your ability to manage loan repayments, potentially leading to more favorable offers from lenders.

Crafting a Long-term Financial Plan

Successfully managing a bill consolidation loan requires considering the broader context of personal financial stability. Developing a comprehensive budget can help ensure that loan payments are manageable alongside other expenses. Additionally, exploring financial literacy resources can provide insights into effective money management and debt reduction strategies. Recognizing a consolidation loan as part of a larger financial plan can foster long-term financial health and resilience, preventing a recurrence of debt challenges in the future.

Finding the Right Lender for Your Bill Consolidation Loan

1. https://sieuthi-viet.com/archive/3145/

2. https://sieuthi-viet.com/archive/3170/

3. https://sieuthi-viet.com/archive/3182/

When searching for a bill consolidation loan, it’s crucial to shop around and compare offers from multiple lenders. Look for lenders that specialize in loans for borrowers with bad credit, as they may be more willing to work with you and offer more favorable terms.

Some key factors to consider when evaluating potential lenders include:

Credit score requirements

When evaluating potential lenders, it’s essential to understand their credit score requirements, as these can vary significantly. Some lenders may cater specifically to those with bad credit, potentially offering more lenient credit score prerequisites. However, these loans might come with higher interest rates. It’s advantageous to assess a lender’s willingness to consider additional factors beyond credit scores, such as your income level and current employment status.

Interest Rates and Fees

Interest rates and associated fees can greatly impact the affordability of a bill consolidation loan. While a lower interest rate is preferable, it’s vital to also understand any additional fees the lender may charge, such as origination or prepayment fees. These costs can affect the total financial benefit of the loan, so a thorough comparison of different lenders’ terms is advisable.

Customer Support and Transparency

The level of customer support provided by a lender can play a crucial role in your borrowing experience. Look for lenders who are transparent about their loan terms and willing to answer any questions you may have. Good customer service can assist you in navigating any challenges throughout the loan process and provide ongoing support if needed.

Reputable and Licensed Lenders

Ensure that any lender you consider is reputable and fully licensed. Conducting research on online reviews, and checking with regulatory agencies can help verify a lender’s credibility. Choosing a trustworthy lender can protect you from predatory lending practices and ensure that you receive a fair deal.

Improving Your Chances of Approval: Credit-Boosting Strategies

By carefully considering these factors, you can increase your chances of finding a bill consolidation loan that meets your financial needs and helps you effectively manage your debt. In the following section, we will explore strategies for maintaining long-term financial stability after obtaining a loan.

Improving your credit score before applying for a bill consolidation loan can significantly increase your chances of approval and securing a better interest rate. Here are some tips to consider:

Pay all bills on time

Paying all your bills on time is one of the most effective ways to boost your credit score. Timely payments contribute significantly to credit score calculations and demonstrate reliability to potential lenders. Setting up automated payments or reminders can help ensure that no payment is missed. Additionally, prioritizing the full payment of bills when possible, rather than just the minimum amount, can help reduce overall debt levels and improve credit standing. As you continue to pay your bills on time, the positive changes in your credit score can lead to more favorable loan terms in the future. Moreover, maintaining a healthy debt-to-credit ratio by not maxing out your credit cards will further enhance your credit profile.

Rebuilding Credit After a Loan

After securing a bill consolidation loan, it’s vital to continue working on rebuilding and maintaining a good credit score. Demonstrating responsible credit behavior post-loan can lead to enhanced financial opportunities down the line. Consistent, on-time loan repayments are vital, as they positively contribute to your credit history.

Monitor Your Credit Report Regularly

Regularly reviewing your credit report is an essential practice for managing your financial health. Checking your report enables you to keep track of your credit score’s progress and identify any discrepancies or fraudulent activities that may arise. By addressing inaccuracies promptly, you can maintain a positive credit profile and avoid potential setbacks in credit rebuilding.

Utilize Credit Wisely

Once you’ve consolidated your debts, be cautious in your use of credit to avoid falling back into financial strain. Utilize credit for necessary expenses only and aim to pay off the balance in full each month. This strategy not only prevents additional debt accumulation but also demonstrates disciplined credit management.

Diversify Your Credit Portfolio

For long-term credit building, consider diversifying your credit portfolio by incorporating different types of accounts, such as credit cards, installment loans, or a personal line of credit. A mixed credit portfolio can positively impact your credit score, provided you manage each type responsibly.

1. https://sieuthi-viet.com/archive/3786/

2. https://sieuthi-viet.com/archive/3145/

3. https://sieuthi-viet.com/archive/3182/

By implementing these credit-boosting strategies and maintaining vigilant financial practices, you can successfully leverage a bill consolidation loan to pave the way for improved financial health and stability.

Exploring Alternatives to Bill Consolidation Loans

If a bill consolidation loan doesn’t seem like the right fit, there are other options worth considering:

Balance transfer credit cards

Balance transfer credit cards allow you to transfer existing high-interest debt to a new card with a lower interest rate, often with an introductory 0% APR for a certain period. This option can be beneficial if you are able to qualify for a card with favorable terms and you have the discipline to pay off the balance within the promotional period. It’s important to consider the balance transfer fee, which is typically a percentage of the amount being transferred. This fee, along with the duration of the 0% APR offer, should be weighed against the savings you will achieve by reducing your interest costs. Remember to have a plan in place to pay off your transferred balance before the regular interest rate resumes, to avoid falling back into high-interest debt.

Debt Management Plans

Another alternative to bill consolidation loans is enrolling in a debt management plan (DMP) through a credit counseling agency. These plans involve a negotiated agreement with your creditors to reduce interest rates or waive certain fees, allowing you to pay off your debts systematically through single monthly payments to the agency. DMPs can simplify the repayment process and help you regain control of your finances over time. However, it’s crucial to work with a reputable agency that is accredited and offers services tailored to your specific needs. Participation in a DMP can require closing existing credit accounts, impacting your credit availability briefly, but the plan’s long-term benefits can outweigh this initial inconvenience.

Home Equity Loans or Lines of Credit

For homeowners, utilizing the equity in your home could be another avenue to consider. Home equity loans or lines of credit often have lower interest rates compared to unsecured debt options because they are secured by the value of your home. This approach may offer significant savings on interest payments, depending on the equity available and current market rates. However, it’s important to recognize the risk involved, as your home is used as collateral. Failing to meet payment obligations could result in foreclosure. Therefore, only consider this option if you have a stable financial outlook and are confident in your ability to make consistent payments.

The Impact of Consolidating Debt on Your Credit Score

While a bill consolidation loan can have both positive and negative impacts on your credit score, the overall effect is typically beneficial in the long run. The initial hard credit inquiry required for the loan application may cause a slight dip in your scores, but making on-time payments and reducing high-interest debts can ultimately improve your credit over time.

By consolidating multiple debts into a single, lower-interest loan, you can potentially improve your credit utilization ratio, which is a significant factor in your credit score calculation. Additionally, the consistent, on-time payments you make on the consolidated loan can demonstrate responsible debt management to credit bureaus.

However, it’s important to note that if you continue to use the credit cards you’ve paid off, or take on additional debt, your credit score may suffer. Maintaining financial discipline and avoiding new debt are crucial to ensuring the long-term benefits of a bill consolidation loan.

Conclusion

In conclusion, managing debt effectively involves a strategic approach that considers both current financial health and long-term goals. Whether you choose a bill consolidation loan, a balance transfer credit card, a debt management plan, or a home equity loan, each option requires careful planning and disciplined financial behavior. By understanding the implications of each debt management strategy and selecting the one that aligns with your needs, you can work toward reducing financial stress and building a stable economic future. Remember to continually monitor your progress and adjust your plan as necessary to accommodate life’s changes. Engaging with knowledgeable financial professionals and leveraging available resources can further support you on the path to achieving greater financial freedom and well-being.